Everyone

Is my data secure?

Yes it is! We use the latest technology to secure your data.

All data entered is encrypted using industry standard Transport Layer Security (TLS) and Rest when backing up.

We use the secured and professional third party local hosting service provider – ORION VM Australia (http://www.orionvm.com/why-orionvm/) and for our data centre requirement.

We also continuously monitor potential security threats by tracking irregular and suspicious activity.

Want to know more? Click here to read our security blog post.

What systems requirements do I need to access GovReports?

Latest internet browsers including Google Chrome, Firefox, Safari, Microsoft Edge, ...etc.

How do I add extra users to my account?

Once you’ve subscribed and completed the registration, you can add extra users to your account. Each additional user will require an Additional User Licence and is transferrable during the licence term so, when one staff member leaves, you can easily transfer to the new staff.

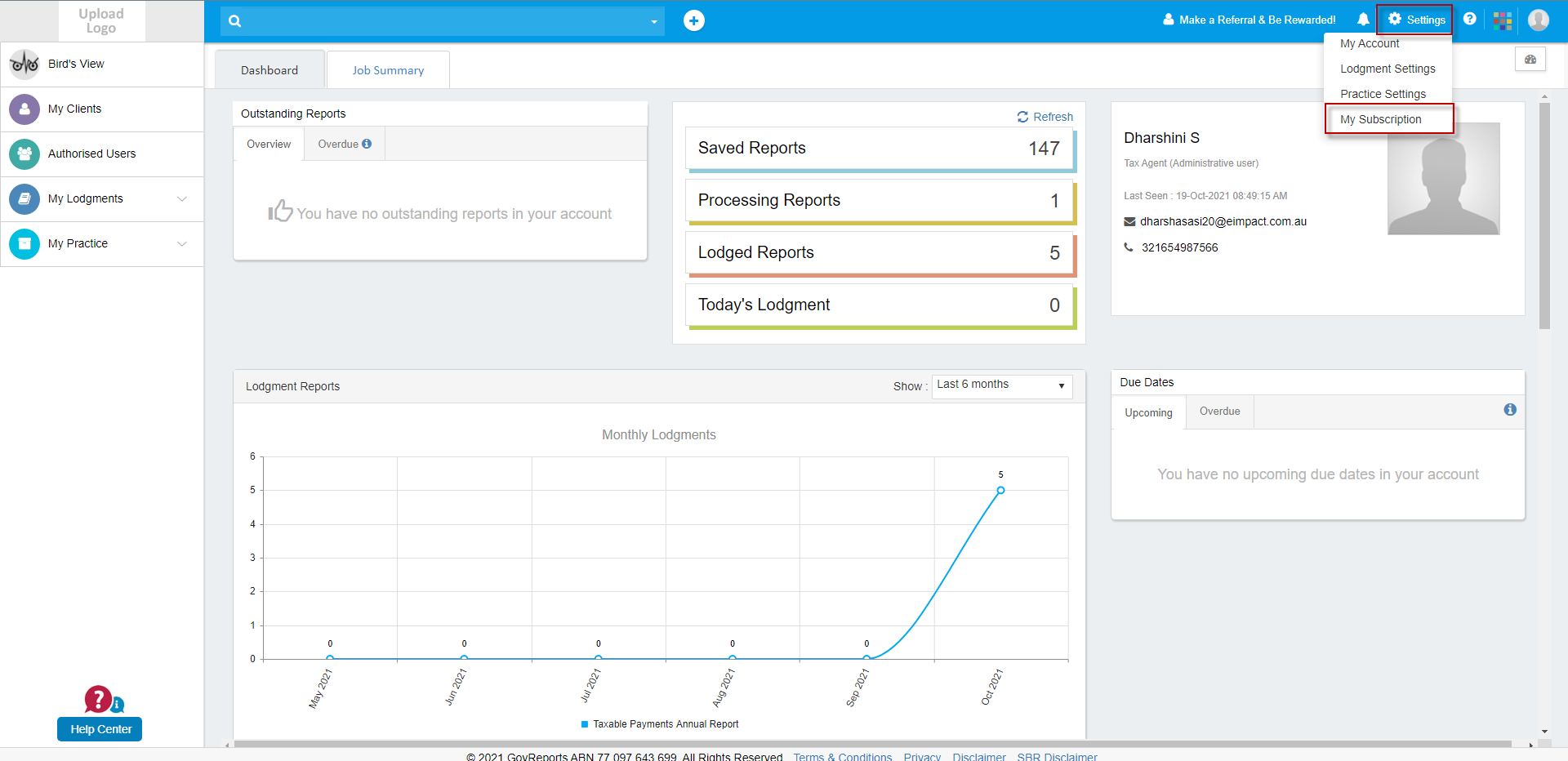

To purchase the Additional User Licence,Step 1 - Go to "Settings" and select "My Subscription"

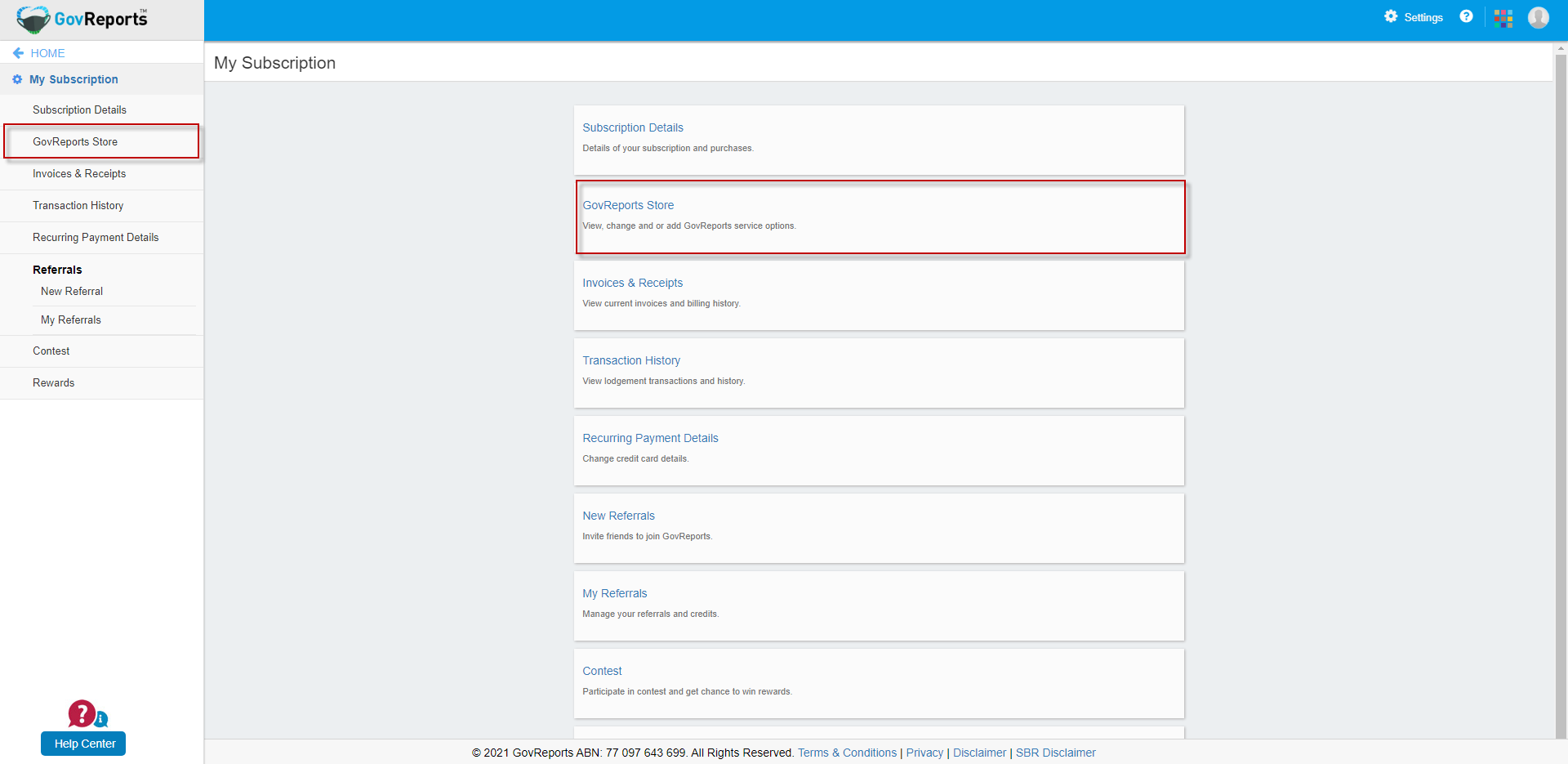

Step 2 - Select "GovReports Store"

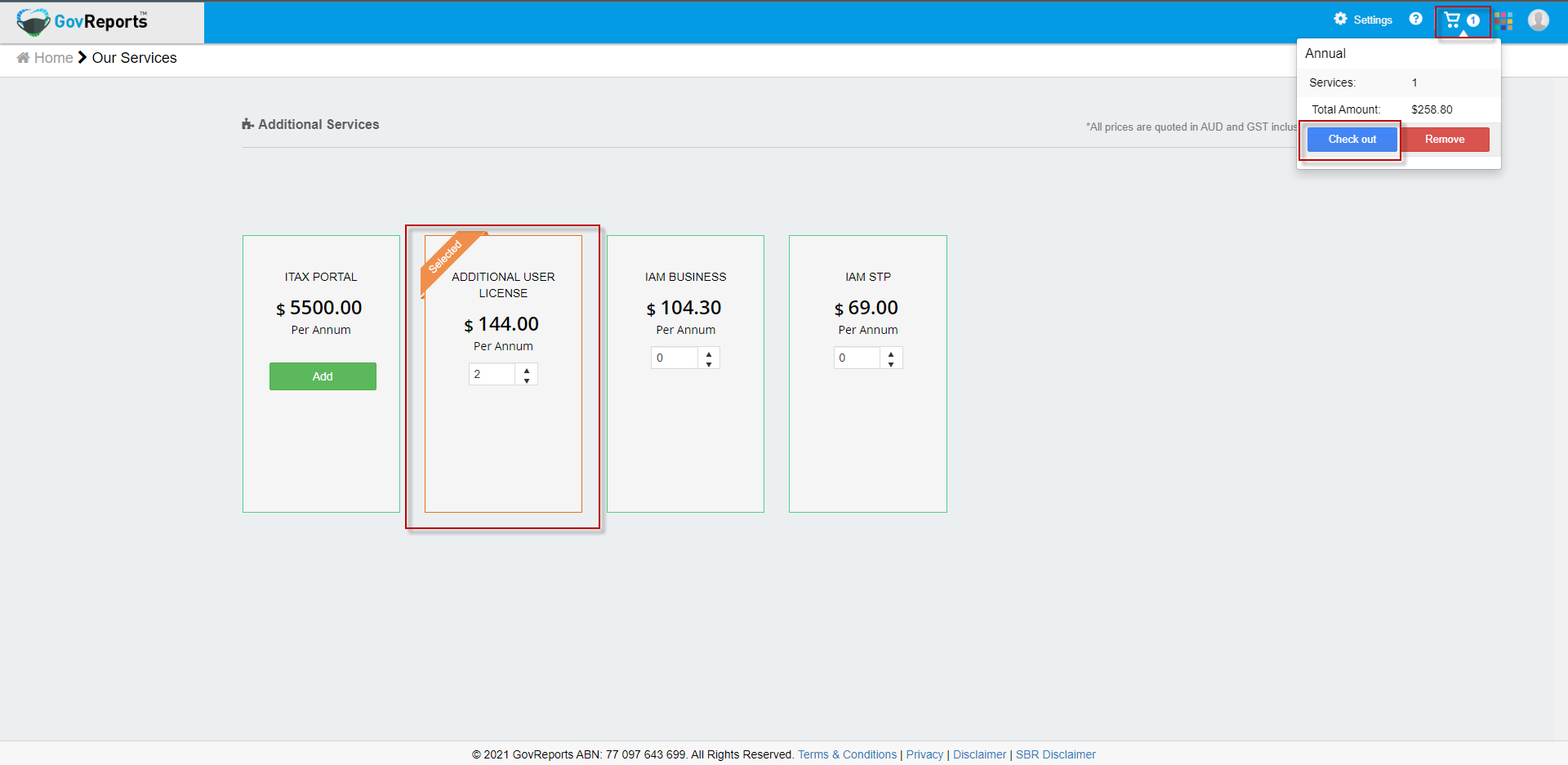

Step 3 - Enter the number of licenses in the Additional User Licence . Click on shopping cart on top right corner and click check out

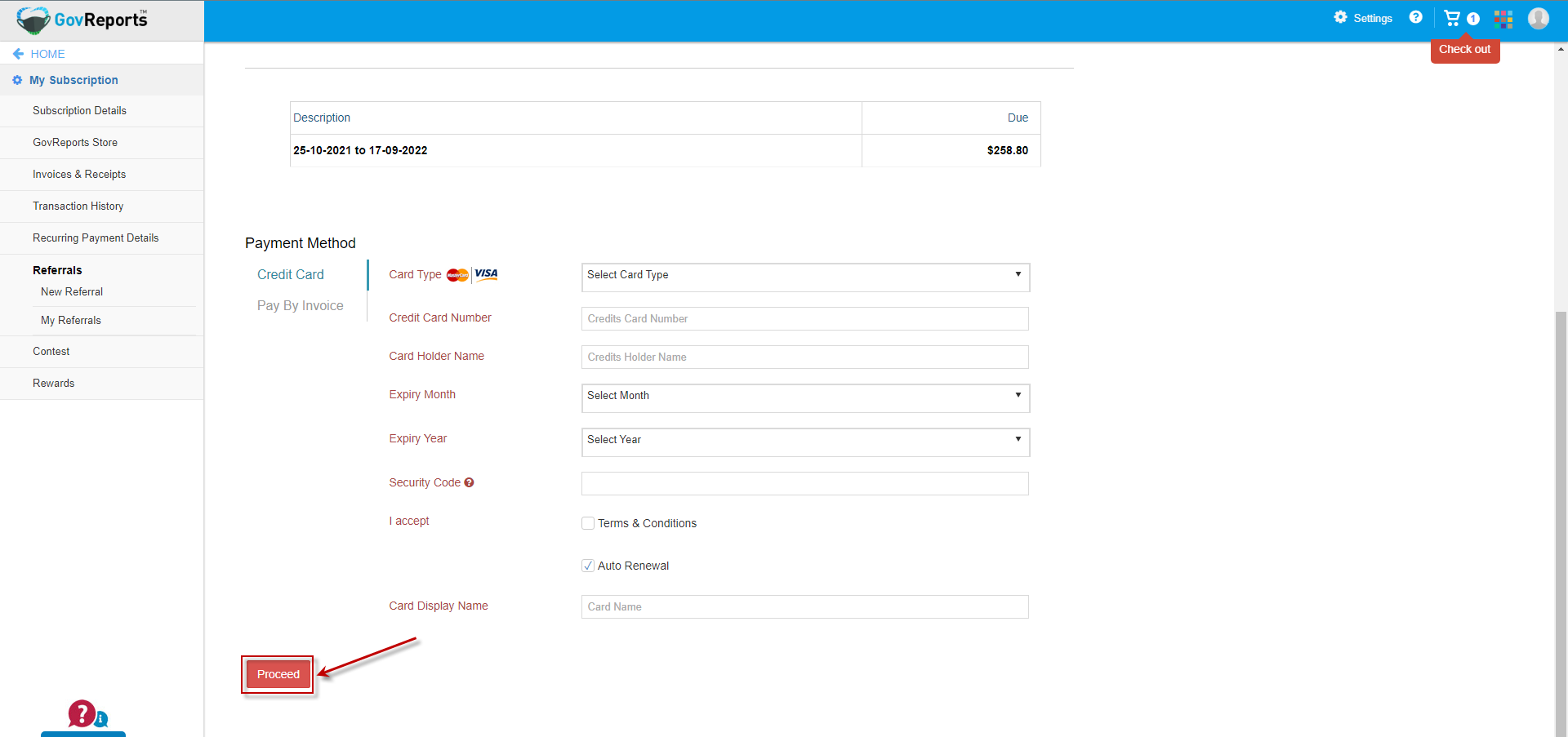

Step 4 - Select your payment payment method and proceed

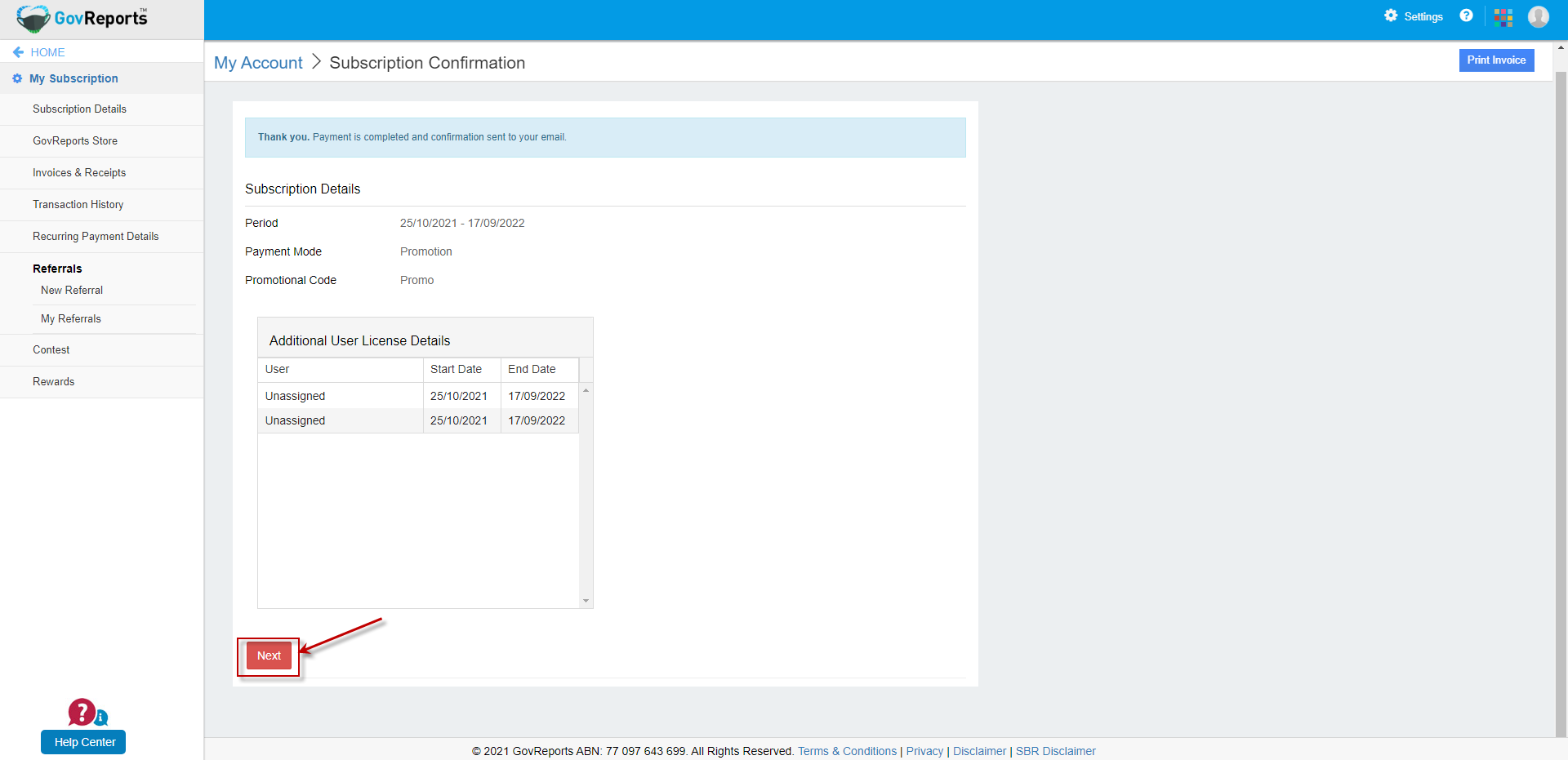

Step 5

Additional User Licence :

- Business $ 72

- BAS Agent $ 84

- Tax Agent $144

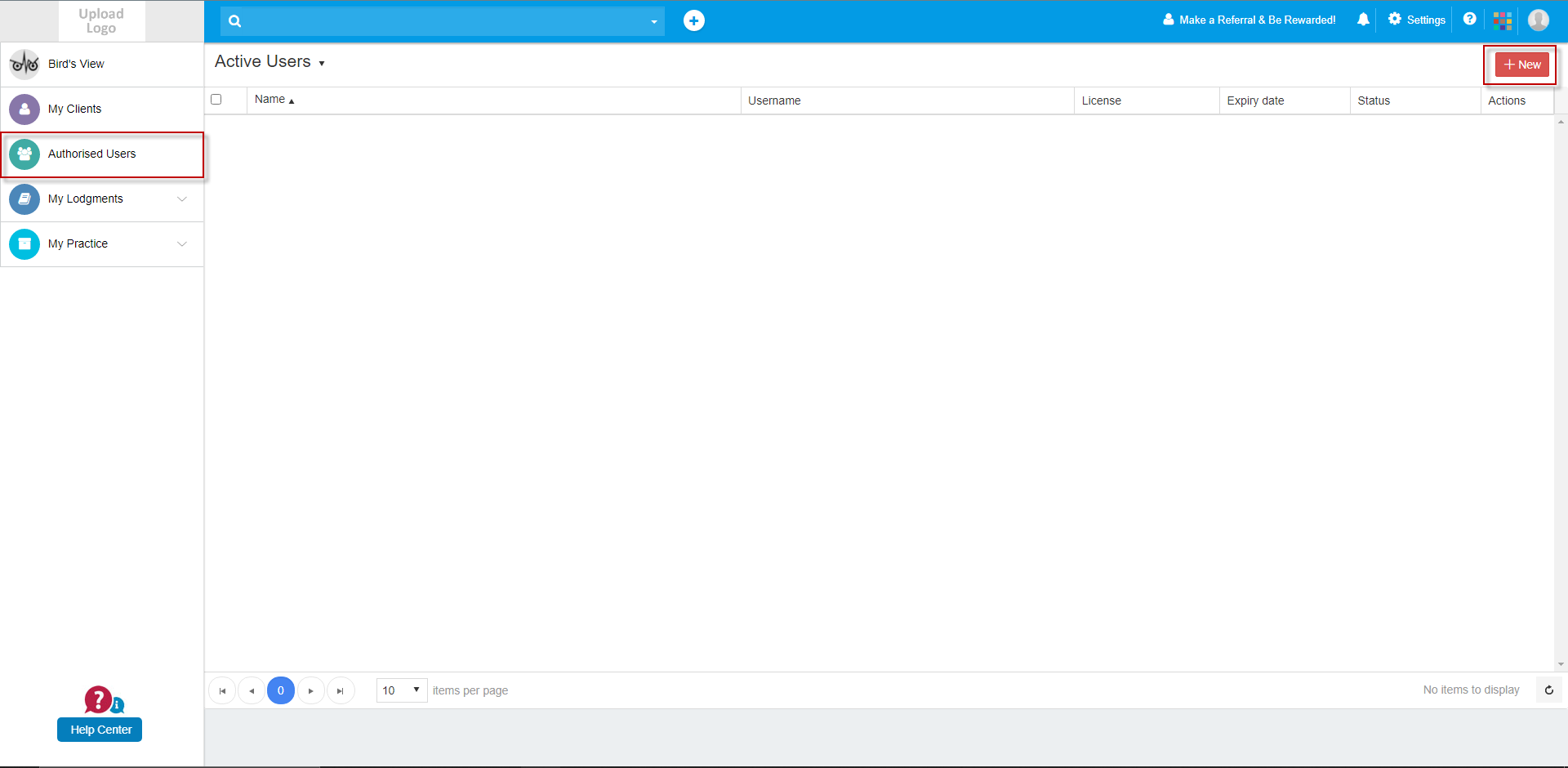

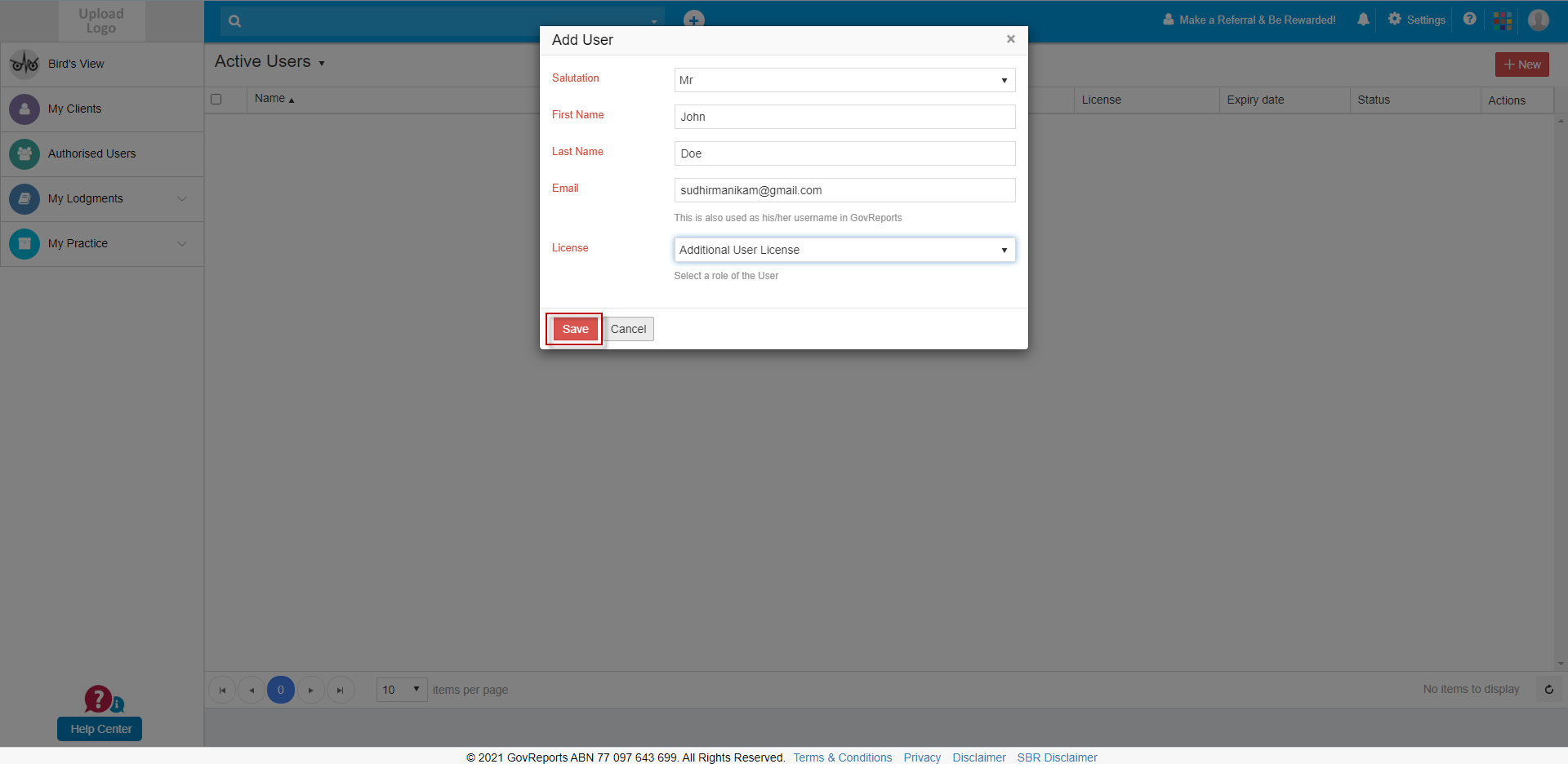

After purchasing the Additional User Licence, go to Authorised Users , click +New to add the detail of the extra user and ensure to allocate Additional User Licence.

The extra user will now receive invitation to login and create their password.

You will need to allocate the role, access and responsibilities of the extra user by click on the user’s name from Authorised User, Action tab and Select User Permission.

You can allocate specific clients or all clients or only new clients to the extra user added as well as the type of forms they can prepare and or lodge for the allocated clients.

Can I export my data?

Yes you can export your client lists and other data to excel. You can also save pdf copies of forms your lodge.

Does digital authentication really replace physical signatures?

Yes our digital authentication system is recognised as a real signature so it really does replace physical signatures!

Can I upgrade my subscription to an unlimited plan later?

You can upgrade your subscription at any time. You will be credited on a pro rata basis any amount you’ve already paid but not used on your current plan.

Can I downgrade/upgrade my subscription from an unlimited to an on-demand plan?

You can downgrade at anytime before your first lodgment under your unlimited plan. Once you’ve made lodgments you can’t downgrade - this is to prevent unfair use of our software. You can downgrade before the renewal date so that you can get onto the on-demand plan next time you renew. Alternatively, if you are already on the On-Demand package, you can always upgrade to an unlimited plan, ie the Essential or Savvy package with your unused credits or at the renewal of your annual plan.

Tax agents

What forms can I lodge via GovReports?

You can lodge all tax-related forms via GovReports. These include:

- Individual income tax returns (from 2012 onwards)

- Company income tax returns (from 2011 onwards)

- Trust tax returns (from 2011 onwards)

- Partnership tax returns (from 2011 onwards)

- SMSF annual returns (from 2011 onwards)

- Activity Statements (IAS/BAS)

- Fringe benefits tax returns (from 2011 onwards)

- Tax file number declarations (TFND)

- Taxable Payment Annual Reports (TPAR)

- Single Touch Payroll (STP)

- PAYG Annual report

- Payroll tax for all States & Territories (check forms availability)

What is included in the tax Agent Essential Plus or Savvy Practice package?

- All lodgment forms accessible to tax agent

- GovReports Office Practice Manager

- GovReports IAM Ledger for accountant

- GovReports Digital Signature

- ATO Online Services

Why do you need my Tax agent number?

We need this number to verify that you’re a Tax agent and are authorised to lodge the forms that we’ll make available to you.

What is included in Savvy Agent package?

- All non-tax return forms for lodgment including Activity Statements, Single Touch Payroll (STP), PAYG Payment Summary Annual Reports, Tax File Number Declarations, Taxable Payments Annual Reports, Payroll Tax to All States & Territories (Check payroll tax forms availability).

- GovReports Office Practice Manager

- Digital Signature

- ATO online services

What is included in On-Demand Package?

- GovReports Office Practice Manager

- GovReports Digital Signature

- ATO Online Services

BAS agents

What forms can I lodge via GovReports?

You can lodge all BAS agent forms via GovReports. These include:

- Activity Statements (IAS/BAS)

- Tax file number declarations

- Taxable Payment Annual Reports (TPAR)

- Single Touch Payroll (STP)

- PAYG Annual report

- Payroll tax for all States & Territories (Check forms availability)

What services do I get for Savvy Agent package?

- All reporting forms accessible for BAS agents from GovReports

- GovReports Office Practice Manager

- GovReports Digital Signature

- ATO Online Services

What services do I get for the On-Demand package?

- GovReports Office Practice Manager

- GovReports Digital Signature

- ATO Online Services

- Accessible to all BAS agent’s reporting forms at $13.75 or STP at $6.60 per lodgment

Why do you need my BAS agent number?

We need this number to verify that you’re a BAS agent and are authorised to lodge the forms that we’ll make available to you. If you’re an ICB member this number will also allow you to get access to the special ICB pricing.

Business

What forms can I lodge via GovReports?

You can lodge all SBR enabled forms via GovReports. These include:

- Company income tax returns (from 2012 onwards)

- Trust tax returns (from 2012 onwards)

- Partnership tax returns (from 2012 onwards)

- SMSF annual returns

- Activity Statements (IAS/BAS)

- Fringe benefits tax returns

- Tax file number declarations (TFND)

- Single Touch Payroll (STP)

- Taxable Payment Annual Reports (TPAR)

- PAYG Annual report

- Payroll tax for all States & Territories (Check forms availability)

Why can’t I lodge my individual tax return via GovReports?

The ATO currently only allows tax agents to lodge individual tax returns using SBR. Therefore unless you use a tax agent you need to prepare your tax return using a government provided service.

How do I prepare my own personal tax return?

- If you have a simple and straight forward tax situation, ATO MyTax portal enables you to fill & file your own tax return direct to ATO.

- If you have a more complex tax situation or unsure how to maximise your tax refund, HubeX portal enables you to fill out your details and connect to your accountant or other registered tax agent online to review and lodge the tax return on your behalf to the ATO.

- For older tax returns, they can be completed and lodged via a registered tax agent from HubeX portal or fill out paper forms to send to ATO.

How do I prepare my business tax return?

- If your business structure is a company, trust or partnership, you can prepare and lodge your own business tax returns via SBR enabled software like GovReports which provides online tax forms for you to complete and file direct to ATO. Alternatively, you can engage a registered tax agent to assist you to complete the tax return forms to file to ATO on your behalf.

- If you are a sole trader, you can do your tax return online via the ATO MyTax portal or via a registered tax agent/accountant.

How to prepare corporate tax return ?

- Depending on the category and structure of your corporation, tax determination and preparation can be done internally or engaged a professional firm for the job.

- If the business structure is a company, trust or partnership, you can prepare and lodge your own business tax returns via SBR enabled software like GovReports which provides online tax forms for you to complete and file direct to ATO. Alternatively, you can engage an accountant as a registered tax agent to assist you to complete the tax return forms to file to ATO on your behalf.

Can an individual lodge a company tax return?

- You can lodge your own company tax returns via SBR enabled software like GovReports or engage an accountant as a registered tax agent to prepare and lodge the company tax return on the business behalf.

- You can not lodge tax returns on behalf of a business entity if you are not an authorised employee or an engaged accountant or a TPB registered tax agent.

Can a business owner file their own taxes?

- The simple answer is yes. You can prepare and lodge your own business taxes via SBR enabled software like GovReports if your business structure is a company, trust or partnership.

- If you're a sole trader, you can file your own taxes on ATO portal or alternatively you can lodge compliant reports via SBR enabled software like GovReports and tax returns via registered tax agent

Can I do my own tax return as a sole trader?

- If you're a sole trader, you can file your own taxes on the ATO portal or alternatively you can lodge compliant reports via SBR enabled software like GovReports and tax returns via registered tax agent on HubeX.

- Regardless of the option you choose to file tax return, you must complete the section for business items to demonstrate your business income and expenses on your tax return, otherwise it isn't considered an income for tax purposes.

How to file a corporation tax return?

- Depending on the category and structure of your corporation, tax determination and preparation can be done internally or engaged a professional firm for the job.

- If the corporate structure is a company, trust or partnership, tax returns can be prepared internally and filed via SBR enabled software like GovReports which provides online tax forms to be filled and filed direct to ATO. Alternatively, you can engage professional accounting firm to assist you to complete the tax return forms and file to ATO on your behalf.

Can I prepare my own tax return?

- If you have a simple and straight forward tax situation, ATO MyTax portal enables you to fill & file your own tax return direct to ATO.

- If you want your tax return to be reviewed by a professional or have a more complex tax situation or unsure how to maximise your tax refund, HubeX portal enables you to fill out your details to share and connect to your accountant or other registered tax agent to review and lodge the tax return on your behalf to the ATO.

- For older tax returns, they can be completed and lodged via a registered tax agent from HubeX portal or fill out paper forms to send to ATO.

Can I prepare my 2022 tax return?

- If you have a simple and straight forward tax situation, ATO MyTax portal enables you to fill & file your own tax return direct to ATO.

- If you have a more complex tax situation or unsure how to maximise your tax refund, HubeX portal enables you to fill out your details and connect to your accountant or other registered tax agent to review and lodge the tax return on your behalf to the ATO.

- For older tax returns, they can be completed and lodged via a registered tax agent from HubeX portal or fill out paper forms to send to ATO.

Is it hard to do your own tax return?

- If you want to get your tax return to be reviewed by an accountant or have complex deductions on your return, it can be challenging to complete on your own. Then, the option to get it done via a registered tax agent on HubeX online would be recommended to save you the stress and headaches of knowing your rights and entitlement.

- On the ATO MyTax Portal, you can also easily claim basic deductions if you've got receipts handy and knowing your options.

How do I lodge my company tax return?

- If the business structure is a company, trust or partnership, you can prepare and lodge your own business tax returns via SBR enabled software like GovReports which provides online tax forms for you to complete and file direct to ATO. Alternatively, you can engage a registered tax agent to assist you to complete the tax return forms to file to ATO on your behalf.

Per Lodgment Pricing Table

| Number of Lodgments | 1-50 | 51-100 | 101-500 | 501-1000 | 1000+ |

| Price AUD$ | $27.50 | $24.75 | $22.00 | $19.25 | $17.05 |

| Per Lodgement Fee: |

| $6.00 +GST (in AUD) |

| Number of Lodgments | 1-50 | 51-100 | 101-500 | 501-1000 | 1000+ |

| Price AUD$ | $13.75 | $11.00 | $9.35 | $8.25 | $7.15 |