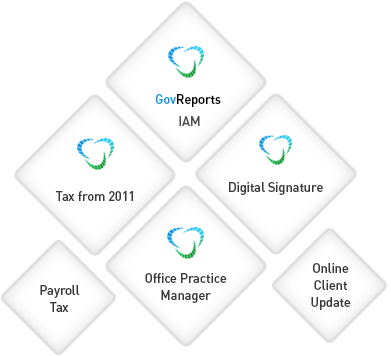

All GovReports tax and BAS agent packages include:

-

SBR enabled software enabled business-to-

government reporting using GovReports PLS tax

software.

-

Office Practice Manager for clients, staff, workflow

and calendar management.

-

Inbuilt digital authentication for authenticated

digital authentication.

-

Default emails, letters and templates for client

communications, with the ability to customise and brand your comms as well.

-

Upload client's trial balance, P&L and balance sheet to prepare financial statements and prefill the

tax returns for lodgment with IAM Accountant's Ledger.

- View the ATO Integrated Client Account in real time.

-

Access to all ATO lodgment forms including Activity Statements, Single Touch Payroll Phase 2, and

Taxable Payments Annual Reports.

- Ability to track lodgment history and view outstanding reports from your dashboard.

- Business tax returns available from 2011 onward.

- Individual income tax returns from 2012 onward.

- Update ATO client details from GovReports to edit, add or remove clients quickly and easily.

- Fast setup so you can get up and running straight away.

- Access from any browser on any device.